Financing

LET US HELP YOU GET THE BEST LOAN

We’ll help you find the best local loan officer to get you competitive rates and the programs that best fit your individual needs. Fill out this form and we’ll connect you with a lender today!

Start the Process

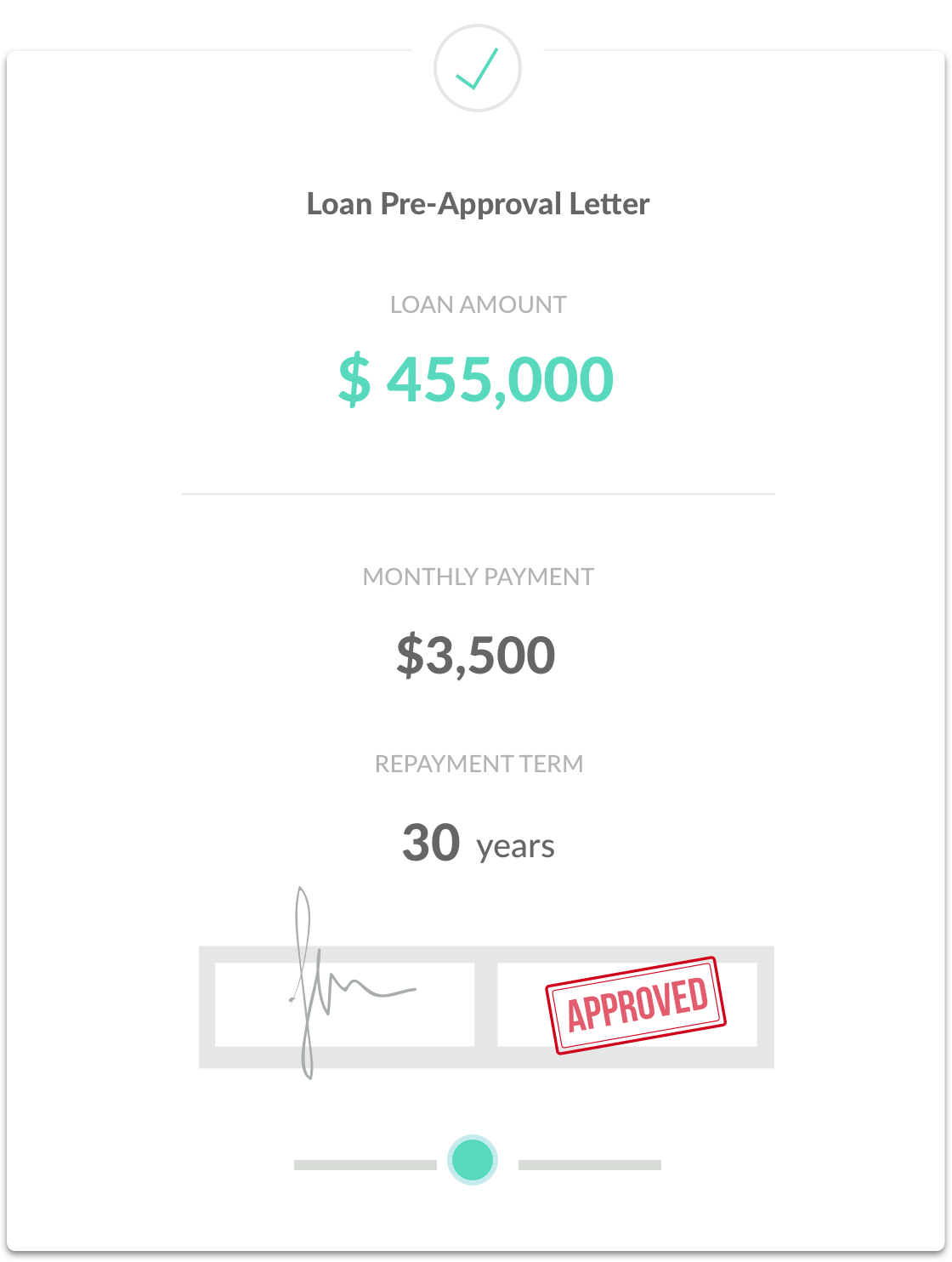

GET PRE-APPROVAL

Before you start looking for a home to buy, it’s a good idea to meet with your Loan Officer to get pre-approved for a loan amount. At this stage, the lender gathers information about income, assets and debts of the borrower (you) to determine how much house you may be able to afford. This includes a credit report, W-2 forms, pay stubs, Federal Tax Returns and recent bank statements. There are a variety of different loan programs, so make sure to get pre-qualification for the specific programs that best suit your needs.

APPLICATION & PROCESSING

WHAT HAPPENS WHEN A LOAN GOES "LIVE"

When you find property you’re ready to buy, your lender will help you complete a full mortgage loan application, and talk you through the various fees and down payment options. The application is submitted to processing, where the documents are reviewed and appraisals and title examination are ordered. Then the loan is sent to an underwriter, who reviews and approves the entire loan if it meets compliance.

CLOSING

SIGNING AND FINALIZING THE DEAL

It's not rocket science to determine your NOI, but we know how to make sure no detail goes uncalculated. We can put together a profitability guide that lines up your expenses including repairs, maintenance, property taxes, utilities, and general operation fees. If the difference between that total and your rental income isn't netting a huge positive, we'll let you know it isn't worth your time.